BOOKKEEPING & ACCOUNTING SERVICES

Blog

What helps you work?

- Pets, music, organisation Have you ever sat down and thought – what helps me work? How can I be the most productive at my job? What distracts me? Do you bring your pet to work- does this help or hinder? Perhaps both? Pets are known to relieve stress, anxiety,...

CJRS – Ends in September

Claim now before it's too late! Final CJRS claims for September can now be submitted and must be made by Thursday 14 October. You can claim 60% of furloughed employees' usual wages for the hours not worked, up to a cap of £1,875 per month per employee....

A word about scams

A word about scams Some helpful tips to protect yourself from getting scammed. Protect yourself against scams!!! Scammers are trying to scam HMRC customers/users, so use these helpful hints and tips to make sure you’re not scammed! It could be a scam if it: Is...

Conditions of claiming CJRS grants

Did you know? You must pay your employees tax and National Insurance contributions to HMRC. This is a condition of applying for the grant, so not doing so will mean they will need to repay the whole of the CJRS grant and they may not be able to claim for future CJRS...

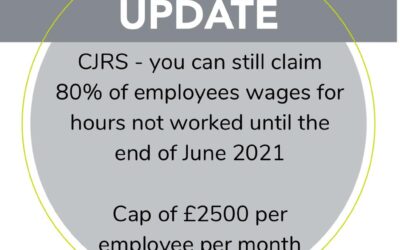

Changes to the CJRS from July 2021

Changes to the CJRS from July 2021 Have you completed yours?Are you aware the UK Government will continue to pay 80% of furloughed employees' usual wages for the hours not worked, up to a cap of £2,500 per month, to the end of June. In July, CJRS grants will cover 70%...

Please feel free to contact us to discuss how we can help you.

We are based in Fleet, Hampshire and cover approximately a 5 mile radius in which are able to visit your premises. We also work remotely and help the majority of our clients via this method. Call us on 01252 594141 or use the contact form below.