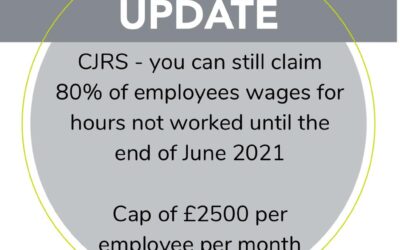

Claim now before it's too late! Final CJRS claims for September can now be submitted and must be made by Thursday 14 October. You can claim 60% of furloughed employees' usual wages for the hours not worked, up to a cap of £1,875 per month per employee....

CJRS – Ends in September

read more