Why is it important to know how to use Xero?

Other disadvantages of not knowing how to use Xero could be incorrect Vat Returns being filed leading to you unknowingly underpaying or overpaying His Majesty’s Revenue and Customs.

Incorrect figures or balances that do not match will lead to inaccurate financial reports. Not knowing how your business is doing could lead to poor financial decisions being made with the worst-case scenario being the closure of your business.

- Items being incorrectly coded – e.g. using asset codes instead of expense codes

- Bank transfers being allocated to Directors Loan Accounts or Dividends in error – this will increase their tax bill as it looks as though they have taken the money for themselves

- Manual entries leading to duplications

- Items left unreconciled, therefore, missed from the VAT return

These mistakes are obviously unintentional but can have a catastrophic effect. Below is some more detail about the errors and what they can cause:

This will cause an imbalance in your software and will lead to the bank balance and the xero balance not being the same. Entering an item twice will cause an imbalance in your accounts and effect your tax obligations. Duplicated transactions can be caused by an error in the bank feed (this is why we advise to check your balances regularly) or by adding manual entries.

Manual Entries

Creating a manual entry may cause a discrepancy in balances when used in conjunction with automatically imported bank feeds. Before manually entering a transaction, make sure this is the correct thing to do and check this will not cause an imbalance.

Items left unreconciled

We have found on numerous occasions, items that have been left unreconciled from within their VAT period. This has led to underpayments or overpayments on their VAT return. Make sure ALL items are reconciled to ensure a correct VAT return is submitted.

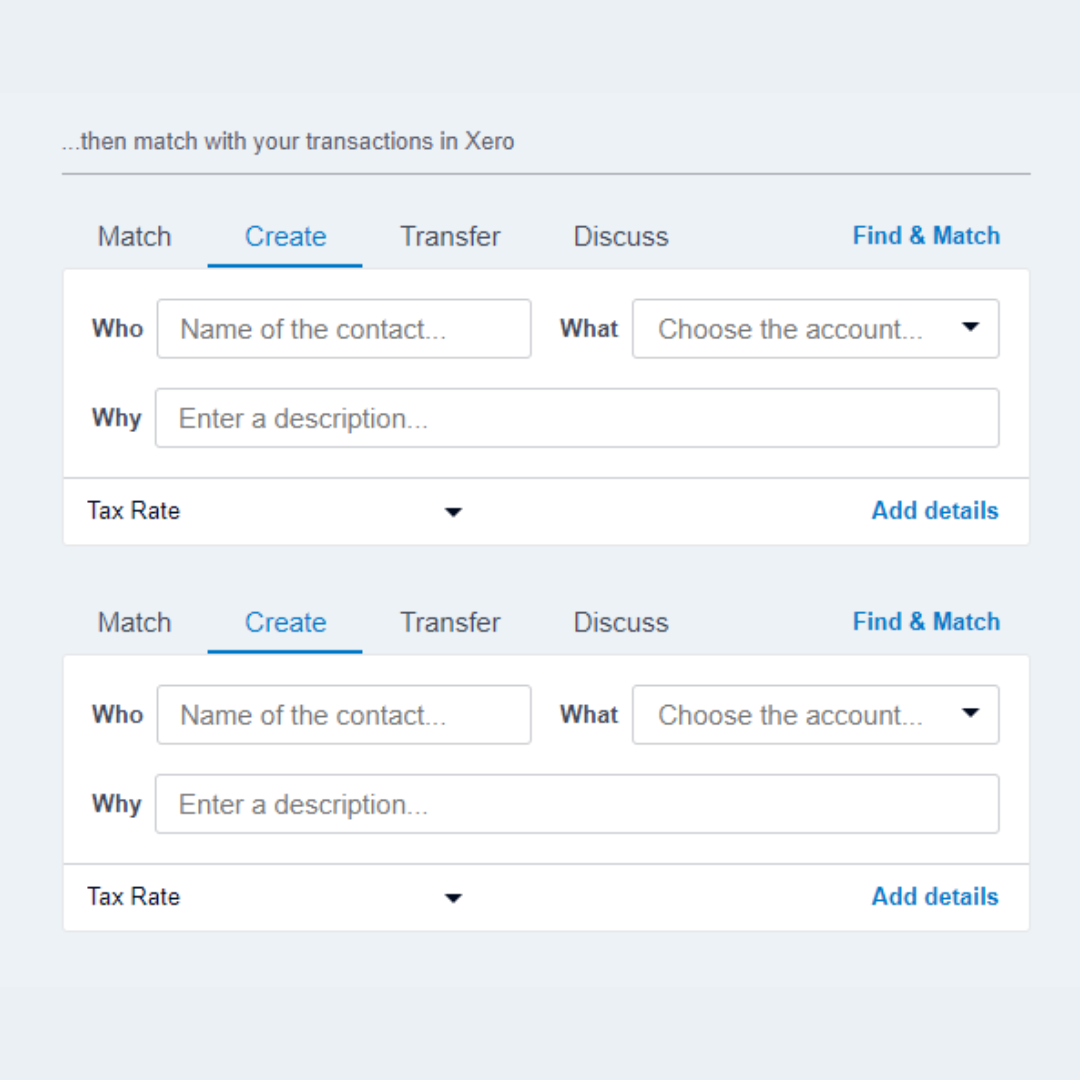

The importance of getting it right with the bank reconciliation tabs

This is the name of the contact. This tab differentiates between which customer or supplier the money has gone to or come from. If the wrong contact has been entered it could mean chasing the wrong customer for unpaid debts or not paying the correct supplier because the batch payments have been inputted wrong.

This is where you choose the correct account. This is very important because if an entry is entered in the wrong place, for example if you were to code a transaction to the directors’ loan account when in fact it was a transfer of funds from one account to another it would mean that that director would be paying far too much tax that year, or if you were to enter an asset instead of an expense, this would affect the balance sheet.

The Why

This is the box where you can enter a description or note to your accountant to inform them or remind yourself of anything important about that transaction.

When you see the box light up green, before you hit reconcile/OK, review the information on the bank statement line matches the transactions in Xero. It is all too easy to hit reconcile when Xero ‘makes a suggestion’ but you could be applying a payment to the wrong customer/supplier.

How can we help?

For more information, please visit our courses page or fill out our contact page below.