BOOKKEEPING & ACCOUNTING SERVICES

COURSES

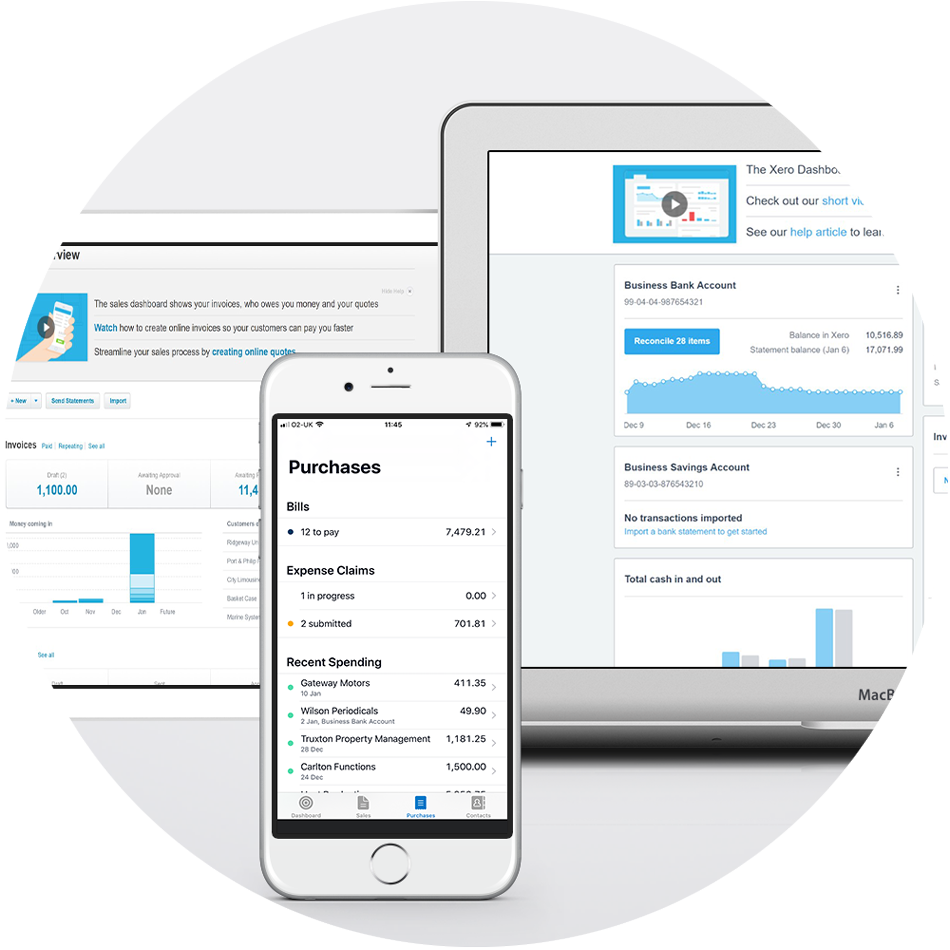

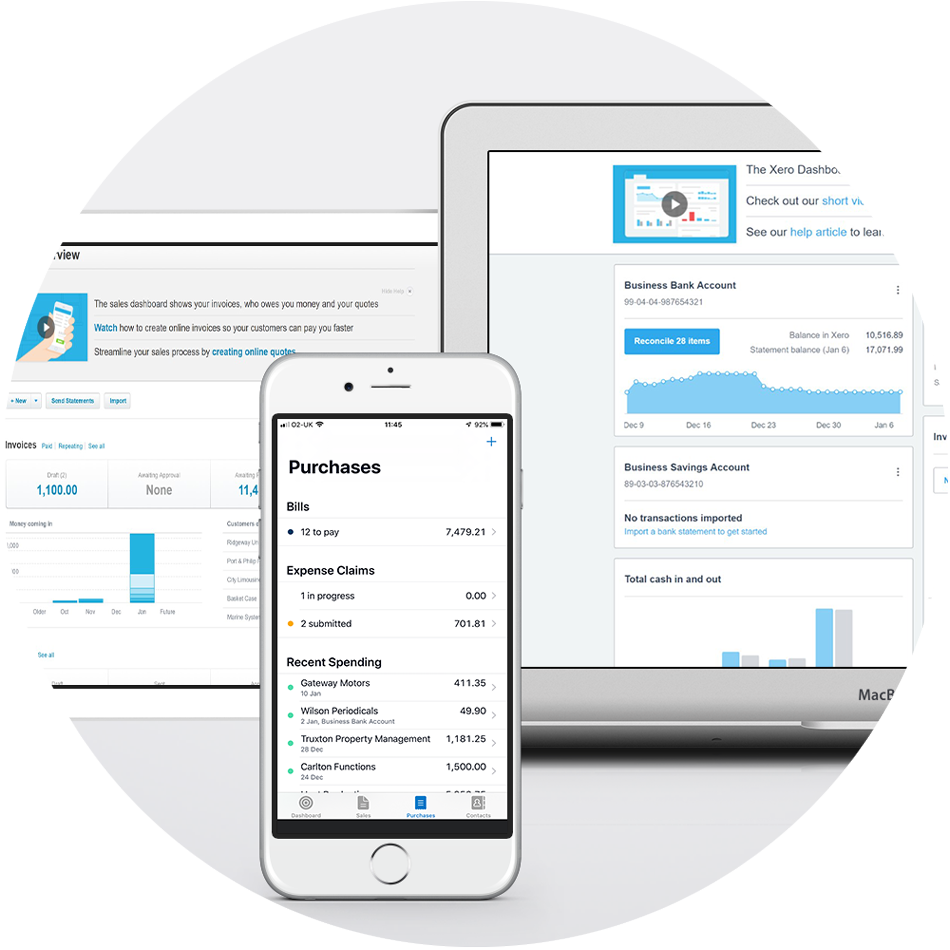

Xero Software Training Courses

Whether you are VAT registered or not, using a software is a great way to keep track of your finances, we offer a variety of Xero Software Training Courses to suit.

Our courses are from 2 – 6 hours in duration and can be used to cover a variety of Xero topics to suit your individual needs. We also have some suggestions below as to what can be included in each course.

PLEASE NOTE – There is a 20% discount for each additional attendee booked on the same course for the same date and time.

Up to 2 Hours

Software Skills

Up to 3 Hours

Getting Started with Xero

Up to 4 Hours

Producing a VAT Return

Up to 6 Hours

Combined Course

Up to 2 Hours

Software Skills

Up to 3 Hours

Getting Started with Xero

Up to 4 Hours

Producing a VAT Return

Up to 6 Hours

Combined Course

Up to 2 Hours

Course suggestion – Software Skills

During this course you will cover a variety of tasks that are frequently performed on a daily basis. This course is designed for individuals who already have a basic understanding in bookkeeping but are unsure how Xero software works. On completion of this course you should be able to:

- Add new Contacts

- Create Quotes

- Create Sales Invoices

- Enter Bills received

- Create Credit Notes

- Reconcile the bank statement

- Produce a VAT return

£120 plus VAT per person

PLEASE NOTE – There is a 20% discount for each additional attendee booked on the same course for the same date and time.

To assist you after your training or at any other time, you may wish to take advantage of one of our Xero Software Support packages. Prices start from only £31 plus VAT per person per month. Click here to find out more.

Up to 2 Hours

Course suggestion – Software Skills

During this course you will cover a variety of tasks that are frequently performed on a daily basis. This course is designed for individuals who already have a basic understanding in bookkeeping but are unsure how Xero software works. On completion of this course you should be able to:

- Add new Contacts

- Create Quotes

- Create Sales Invoices

- Enter Bills received

- Create Credit Notes

- Reconcile the bank statement

- Produce a VAT return

£120 plus VAT per person

PLEASE NOTE – There is a 20% discount for each additional attendee booked on the same course for the same date and time.

To assist you after your training or at any other time, you may wish to take advantage of one of our Xero Software Support packages. Prices start from only £31 plus VAT per person per month. Click here to find out more.

Up to 3 Hours

Course suggestion – Getting Started with Xero

This course is designed to give you the confidence to set Xero Software up for your business. During this course you will cover:

- Setting up your software

- Default Email and Invoice settings

- Adding Contacts

- Creating Sales Invoices

- Entering a Bill

- Files and Attachments

£160 plus VAT per person

PLEASE NOTE – There is a 20% discount for each additional attendee booked on the same course for the same date and time.

To assist you after your training or at any other time, you may wish to take advantage of one of our Xero Software Support packages. Prices start from only £31 plus VAT per person per month. Click here to find out more.

Up to 4 Hours

Course suggestion – Producing a VAT Return

This course is designed to assist you in the data entry and bank reconciliation process required in order to complete your VAT return. During this course you will cover:

- Reviewing the basics (adding a Contact, entering Bills and Sales Invoices)

- Inventory (products and services)

- Chart of Accounts

- Quotes

- Bank Reconciliation

- Filing your VAT Return

£200 plus VAT per person

PLEASE NOTE – There is a 20% discount for each additional attendee booked on the same course for the same date and time.

To assist you after your training or at any other time, you may wish to take advantage of one of our Xero Software Support packages. Prices start from only £31 plus VAT per person per month. Click here to find out more.

Up to 4 Hours

Course suggestion – Producing a VAT Return

This course is designed to assist you in the data entry and bank reconciliation process required in order to complete your VAT return. During this course you will cover:

- Reviewing the basics (adding a Contact, entering Bills and Sales Invoices)

- Inventory (products and services)

- Chart of Accounts

- Quotes

- Bank Reconciliation

- Filing your VAT Return

£200 plus VAT per person

PLEASE NOTE – There is a 20% discount for each additional attendee booked on the same course for the same date and time.

To assist you after your training or at any other time, you may wish to take advantage of one of our Xero Software Support packages. Prices start from only £31 plus VAT per person per month. Click here to find out more.

Up to 6 Hours

Course suggestion – Combined Course

This in depth training covers the topics mentioned in both the Up to 3 Hours and Up to 4 Hours Course suggestions. By the end of this course you will be able to set Xero software up for your business before using it to successfully prepare and submit your VAT Return.

£280 plus VAT per person

PLEASE NOTE – There is a 20% discount for each additional attendee booked on the same course for the same date and time.

To assist you after your training or at any other time, you may wish to take advantage of one of our Xero Software Support packages. Prices start from only £31 plus VAT per person per month. Click here to find out more.

Please feel free to contact us to discuss how we can help you.

We are based in Church Crookham, Hampshire and cover approximately a 5 mile radius in which are able to visit your premises. We also work remotely and help the majority of our clients via this method. Call us on 01252 594141 or use the contact form below.