The Bookkeeping Process

A Bookkeeper is responsible for recording and maintaining a business’ financial transactions, such as purchases, expenses, and sales revenue. They will record financial data into general ledgers, which are used to produce the balance sheet and accounts at the year end.

Helpful hint: Ask your bookkeeper to recommend an Accountant if you do not already have one. They will usually have accountants that they already work with and can recommend upon experience.

Managing your finances can be a daunting task, but with our meticulous bookkeeping process, you can rest assure that your accounts are in good hands. We have designed our service to be thorough, efficient and tailored to meet your needs. Here’s a closer look at how we handle your bookkeeping:

Weekly Account Updates

We understand that staying on top of your finances is crucial for your business’s success. That’s why we provide weekly account updates. Every week, we review your transactions and reconcile your accounts. This ensures that your financial data is always current and accurate.

Dedicated Bookkeeper

We pride ourselves on offering a personal service, each client will have a dedicated bookkeeper who will familiarise themselves with your business. Your bookkeeper is your go to person for any questions or concerns you may have.

Monthly list of missing items

Each month your dedicated bookkeeper will send you a missing items list. To maintain the accuracy of your records, it’s essential to have all of the necessary documentation especially if you’re VAT registered. We will send you a list of any missing items, so you can find the relevant documents and upload them to your own dedicated portal. We send the missing items on a spreadsheet so you have the opportunity to leave comments for us about invoices or receipts you cannot locate and include explanations of unclear transactions so we are able to code them correctly.

Timely deadline and return notifications

Deadlines can be stressful but we are here to help and stay on top of them for you.

We monitor all of your important financial deadlines and returns and will send you email notifications well in advance. You will always be informed and prepared, reducing the risk of late penalties and compliance issues.

Our responsibility to our clients remains at the forefront of our decisions and actions. We adhere to the highest ethical standards and pride ourselves on meeting company deadlines and completing tasks in a timely manner. This is clearly documented in our handbooks and is even printed on our office wall, courtesy of Abstract Creative Studio (design) and IQ Digital House (print and installation)

Our process here at Perfect Balance is:

Are you looking for a bookkeeper? You may find our blog When to get help with bookkeeping useful.

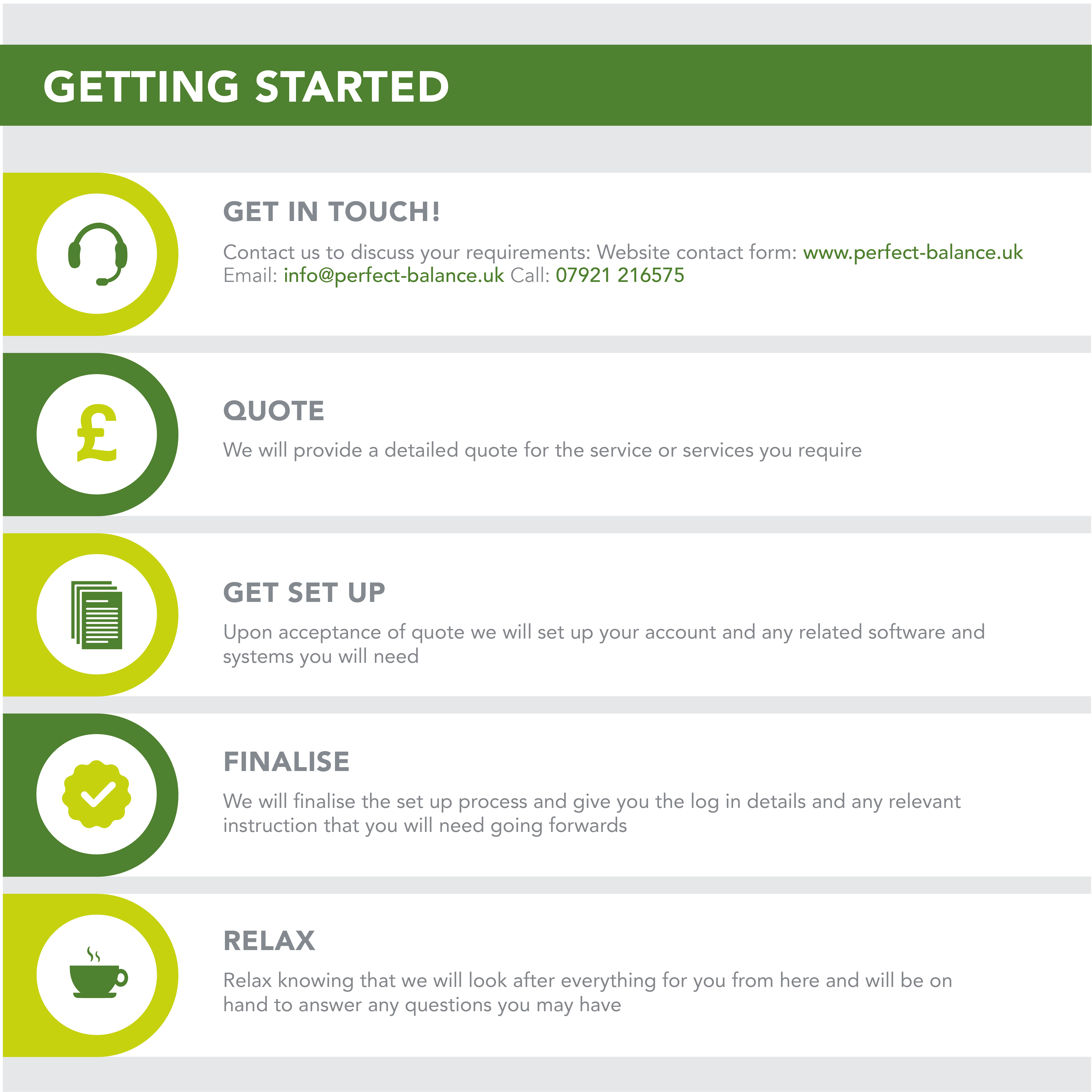

This is how easy it is to get started with us:

Our services include:

- Transaction entries including sales, purchases and direct debits

- Credit control

- Making Payments

- Bank, credit card and cash account reconciliation

- VAT returns

- Monthly/annual reports as requested

- Payroll

- CIS returns and deduction statements

- Tax Returns

We will become an integral part of your support system by offering precise financial information about your business.

We pride ourselves on being approachable, friendly and reliable.

No question is a silly question and we are always happy to help.