The right payment system for your business:

We compare Apron, Xero, Caxton and Modulr

Managing finances efficiently is crucial for success, and selecting the right payment system can help empower businesses like yours to take control of their credit management.

In our previous blog post we explored the key features and benefits of Apron.

We understand that every business is unique and so are their needs.

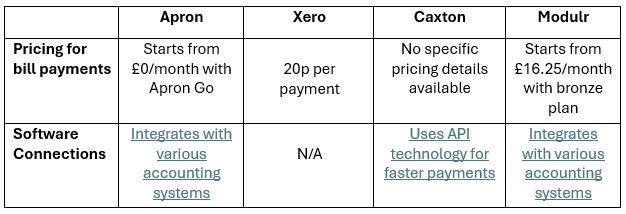

Therefore, we thought it might be useful to compare four popular payment systems in the UK: Apron, Xero, Caxton and Modulr.

APRON

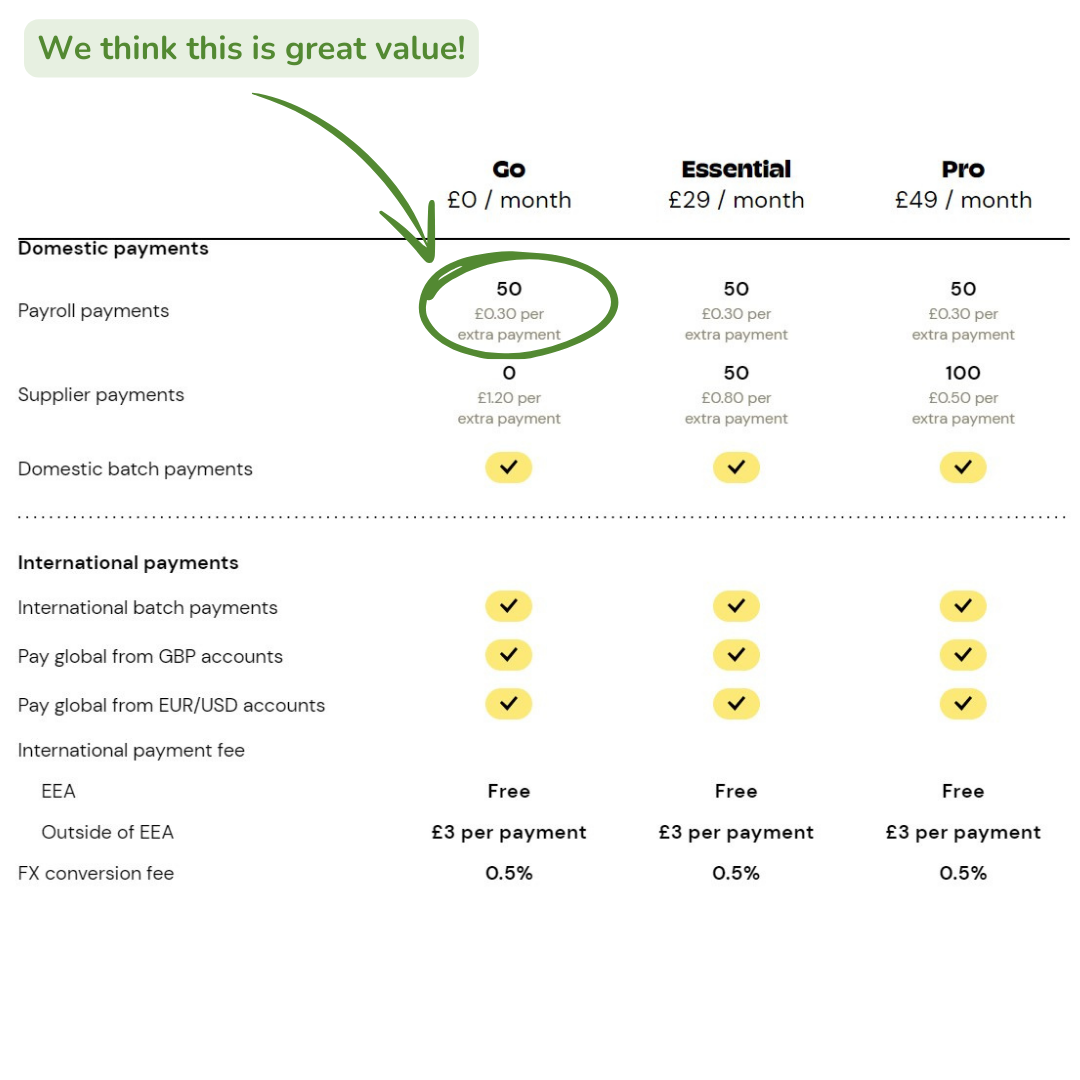

Pricing: Starts at £0 per month, offering different plans based on business needs.

Setup Process: Easy online signup, account setup, and customisation of settings. Import existing data for a smooth transition.

Software Integrations: Currently Apron integrates with Xero and QuickBooks. Connection to your preferred software is a straightforward process.

Click on the link below to find out how to connect Apron to your Xero or QuickBooks software:

https://support.getapron.com/en/articles/8842393-how-do-i-connect-apron-to-xero-quickbooks

Payment Process: Apron links with outstanding bills. You select the bills you’d like to include for payment and simply authorise multiple payments with a click of a button.

XERO

Direct bill payments in Xero are only available to Xero users.

A subscription is required and can be set up quickly and easily with the following monthly cost:

Pricing: Xero has a great offer at the moment. The Starter plan costs £7.50 if you sign up by the 31st July and this is for the software which can also be used to keep track of your business accounting, with tiered pricing based on the number of features.

Setup Process: Click on ‘Bills to Pay’, then ‘Direct Bill Payments’ and ‘Explore and Set up’. Then follow the on-screen instructions to link this to your bank. This will only take a few minutes.

Bill Payments: 20p per payment. If grouping several bills together to one supplier (e.g. if you need to pay 5 bills all to the same supplier) this will count as one payment (20p).

Payment Process: Select the bills you want to pay, click group payments, approve.

See how to pay your bills efficiently with Xero by clicking on this link:

CAXTON

Caxton uses one platform for all your business payments. Global payments, multi-currency accounts, expenses and payroll payments are all in one place.

International Payments: Simplify cross-border transactions and manage foreign currency transactions.

Integration: Embedded payments. Caxton uses API-driven payments technology to make payments easy. You can plug your software into Caxton’s API for faster payments.

Users: UK businesses with international operations, needing efficient currency management solutions.

Pricing: Custom pricing structures, typically involving subscription fees and transaction-based charges tailored to business needs.

Setup Process: Online signup, provide business details, verify identity, and set up accounts.

Click on the link below to find out more:

MODULR

Modulr is an embedded payment system designed for faster and instant payments. Their platform enables businesses to automate payment processes, improving efficiency, speed, and reliability.

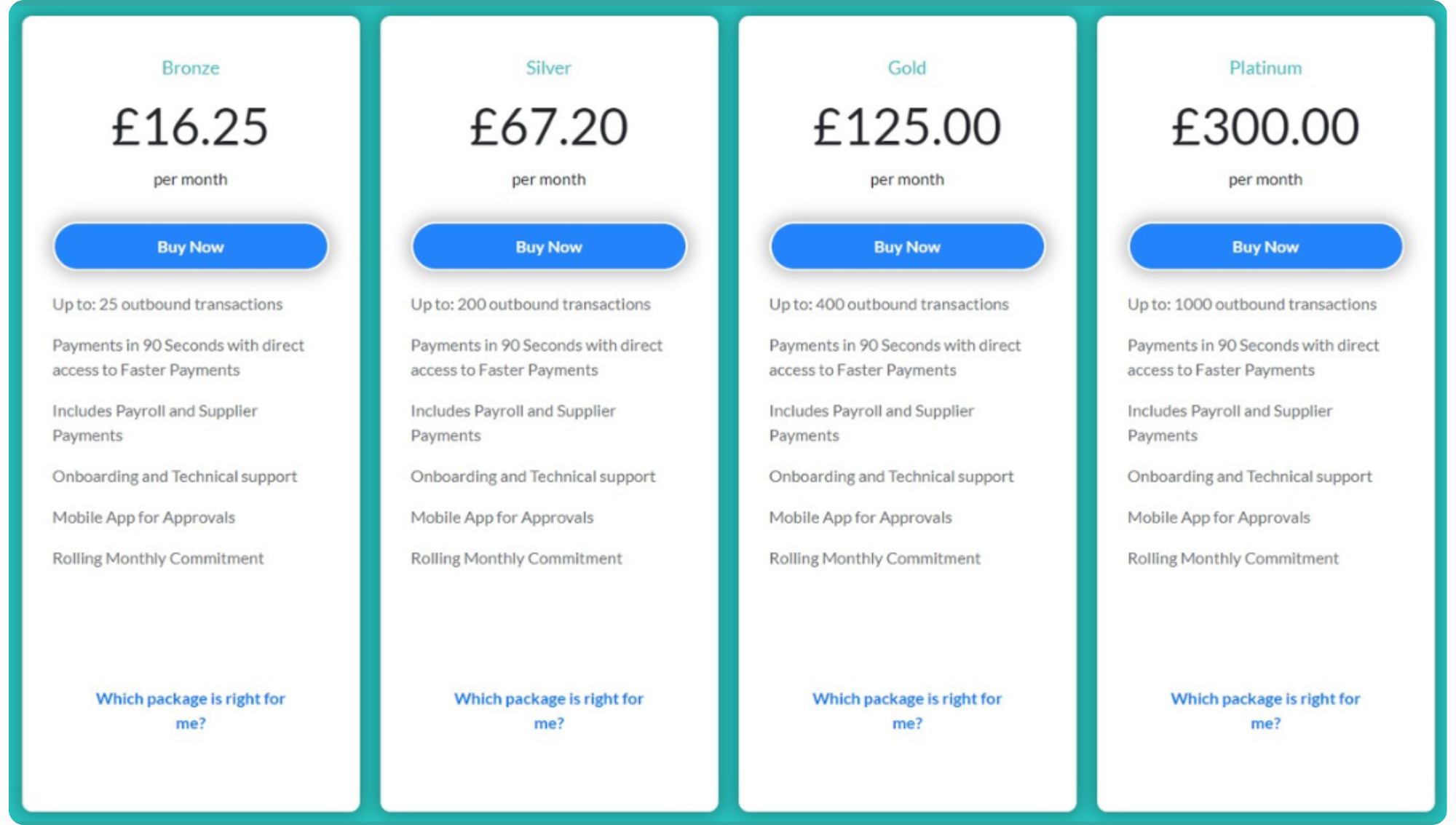

Pricing: Starts at £16.25 per month (Bronze plan), with tiered pricing based on the number of transactions required.

Setup Process: Visit this link to set up your account: https://www.modulrfinance.com/small-business/integrations

Select ‘for your business’ and your software provider, then choose pricing package.

Software Integrations: The good news is that Modulr integrates with major accounting software platforms like Xero, Sage, IRIS, BrightPay UK, BrightPay Ireland, My Digital and Thesaurus Software. You simply select your preferred software and specify the purpose for its usage.

Payment Process: Run accounts payable as normal with Xero. Select ‘bills to pay’ in Xero. Approve pending payments in the Modulr portal. Payments automatically sync with Xero.

In conclusion, choosing the right payment system depends on your business requirements, budget and long-term goals.