BOOKKEEPING & ACCOUNTING SERVICES

BOOKKEEPING

Do you enjoy running your own business, but find managing your accounts and paperwork a chore you could do without?

We will become an integral part of your support system by offering precise financial information about your business

Myself and my small, dedicated team provide a reliable but uncomplicated service ensuring that your accounts are completed accurately and within the required timescale. We will become an integral part of your support system by offering precise financial information about your business.

Many of our clients have been referred to us by accountants who know that we provide high quality, accurate and timely accounts. We will remember and meet your deadlines so you can concentrate on running your business.

Our Services Include:

Monthly Bookkeeping

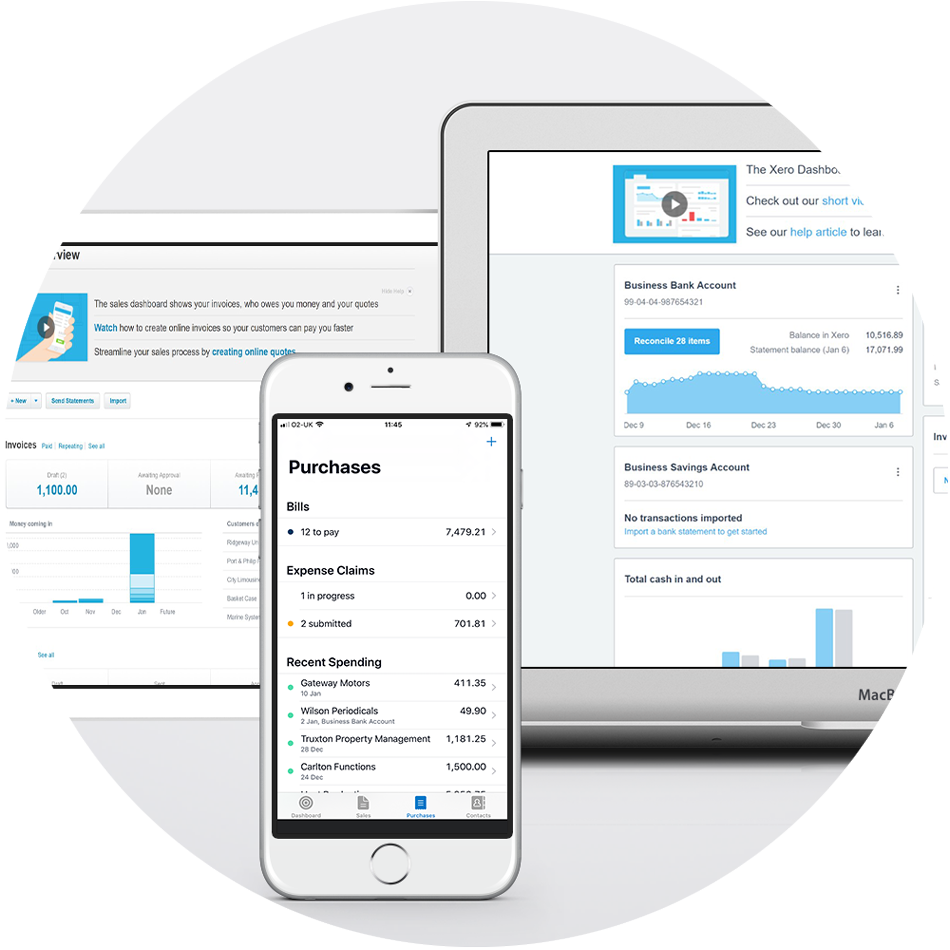

Xero Software Training

Submission of VAT Returns Only

Bookkeeping Support

Software set up

MTD for ITSA

We will become an integral part of your support system by offering precise financial information about your business

Myself and my small, dedicated team provide a reliable but uncomplicated service ensuring that your accounts are completed accurately and within the required timescale. We will become an integral part of your support system by offering precise financial information about your business.

Many of our clients have been referred to us by accountants who know that we provide high quality, accurate and timely accounts. We will remember and meet your deadlines so you can concentrate on running your business.

Our Services Include:

Monthly Bookkeeping

Please contact us to discuss your bookkeeping needs so that we can provide a quote. We have experience using a range of software including Xero, Sage, Quickbooks and Freeagent.

Included within our service:

- Transaction entries including sales, purchases and direct debits

- Bank, credit card and cash account reconciliation

- VAT returns

- Your own dedicated bookkeeper

from £50 per month. Price on quotation

Submission of VAT Returns Only

If you are VAT registered, you will be required to submit VAT returns on a regular basis. If you would like to complete your bookkeeping yourself, you may wish for us to check and submit your VAT return on your behalf to ensure any possible errors are corrected before submission.

Monthly VAT Return £55 plus VAT

Quarterly VAT Return £165 plus VAT

Please note: These costs are for the checking and submission of your VAT return only. This does not include any bookkeeping or data entry which is charged separately. If there are errors that need correcting, we will advise you of these so you can make the amendments before submitting your VAT return. If you would like us to do these amendments on your behalf we will be happy to provide a quote at the time.

Submission of VAT Returns Only

If you are VAT registered, you will be required to submit VAT returns on a regular basis. If you would like to complete your bookkeeping yourself, you may wish for us to check and submit your VAT return on your behalf to ensure any possible errors are corrected before submission.

Monthly VAT Return £55 plus VAT

Quarterly VAT Return £165 plus VAT

Please note: These costs are for the checking and submission of your VAT return only. This does not include any bookkeeping or data entry which is charged separately. If there are errors that need correcting, we will advise you of these so you can make the amendments before submitting your VAT return. If you would like us to do these amendments on your behalf we will be happy to provide a quote at the time.

Submission of VAT Returns Only

If you are VAT registered, you will be required to submit VAT returns on a regular basis. If you would like to complete your bookkeeping yourself, you may wish for us to check and submit your VAT return on your behalf to ensure any possible errors are corrected before submission.

Monthly VAT Return £55 plus VAT

Quarterly VAT Return £165 plus VAT

Please note: These costs are for the checking and submission of your VAT return only. This does not include any bookkeeping or data entry which is charged separately. If there are errors that need correcting, we will advise you of these so you can make the amendments before submitting your VAT return. If you would like us to do these amendments on your behalf we will be happy to provide a quote at the time.

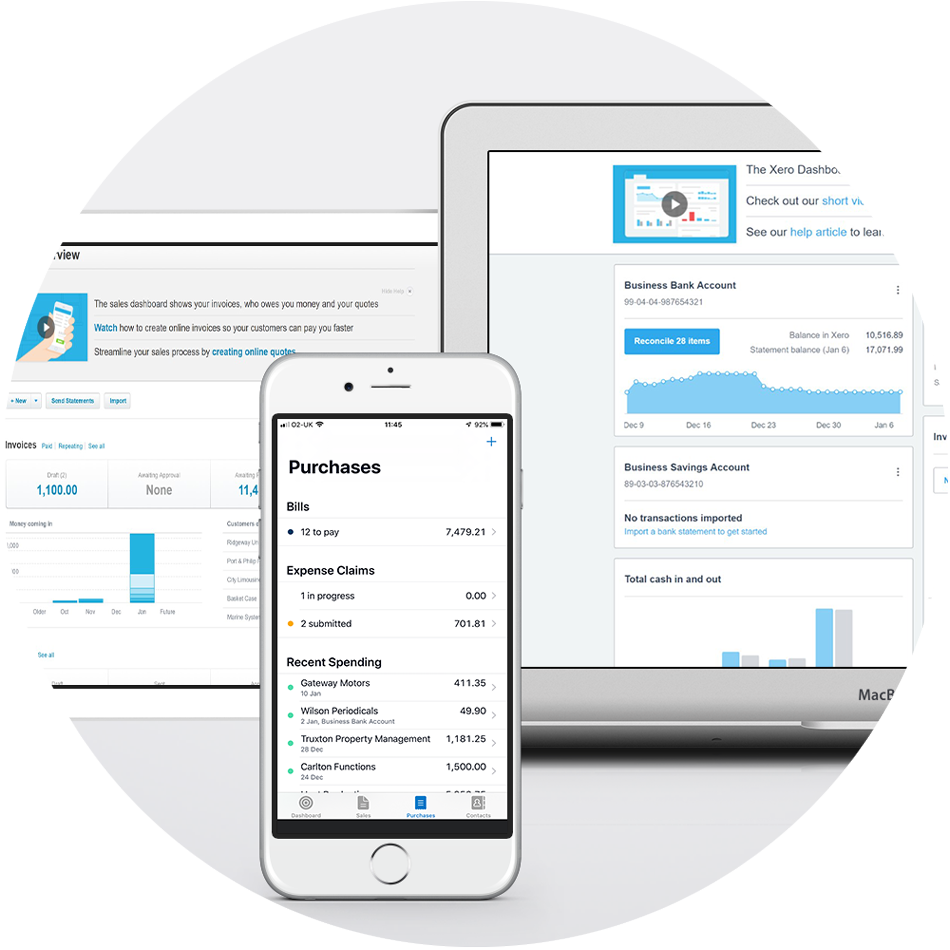

Software set up for New & Existing Businesses

Are you a new business that needs to start from scratch? Maybe you have got to the end of your first year and need to set up an accounting system to complete your bookkeeping in preparation for the accountant to run your year end?

Or maybe you are already using a software but would rather switch to Xero?

Contact us to find out how we can help. We can set up Xero software for you, provide ongoing bookkeeping support or provide training so that you can complete the accounts yourself.

Setup Costs £175 plus VAT

Software Subscription from £15 plus VAT per month

Please note: New businesses only.

Software set up for New & Existing Businesses

Are you a new business that needs to start from scratch? Maybe you have got to the end of your first year and need to set up an accounting system to complete your bookkeeping in preparation for the accountant to run your year end?

Or maybe you are already using a software but would rather switch to Xero?

Contact us to find out how we can help. We can set up Xero software for you, provide ongoing bookkeeping support or provide training so that you can complete the accounts yourself.

Setup Costs £175 plus VAT

Software Subscription from £15 plus VAT per month

Please note: New businesses only.

Xero Software Training

Do you wish to complete your own bookkeeping but are worried about getting things wrong? Maybe you are new to the software and would like some help and guidance? As Xero Certified Advisors we are able to provide a variety of Xero Software training to help you complete your bookkeeping with confidence.

We offer a variety of Xero Software Training Courses. Please see our Courses page to read full course descriptions to find out what is covered and which course is best suited to your needs.

Up to 2 Hours: Software Skills

Up to 3 Hours: Getting Started with Xero

Up to 4 Hours: Producing a VAT Return

Up to 6 Hours: Combined Course

Xero Software Training

Do you wish to complete your own bookkeeping but are worried about getting things wrong? Maybe you are new to the software and would like some help and guidance? As Xero Certified Advisors we are able to provide a variety of Xero Software training to help you complete your bookkeeping with confidence.

We offer a variety of Xero Software Training Courses. Please see our Courses page to read full course descriptions to find out what is covered and which course is best suited to your needs.

Up to 2 Hours: Software Skills

Up to 3 Hours: Getting Started with Xero

Up to 4 Hours: Producing a VAT Return

Up to 6 Hours: Combined Course

Cancellations:

Monthly fee: Cancellations can be requested at any time. Cancellation requests must be received by us in writing no later than 14 days before the end of your current paid period.

6-month package: Cancellations may be requested for the end of the 6-month period. Requests must be received by us in writing no later than 14 days before the end of your current 6-month paid period.

Xero Bookkeeping Support

Let us help you!

Do you want the security of knowing you have somebody to turn to for help? Maybe you carry out your own bookkeeping but have questions every now and then that you could use some help with?

With our Xero Software Bookkeeping Support packages, we are on hand to answer any queries you have. Contact us via email and we will respond to your query within 2 working days.

Please contact us if you would like to take advantage of this service or if you have any questions.

Monthly fee* £40 Payable monthly in advance by direct debit

6-month package £192 (Saving 20%). Payable in advance

*minimum 2 month period required

Please note: All prices are per person and are for advice and support only. If you require help carrying out your bookkeeping tasks this will incur an additional cost that will be discussed at the time. Prices are excluding VAT

Xero Bookkeeping Support

Let us help you!

Do you want the security of knowing you have somebody to turn to for help? Maybe you carry out your own bookkeeping but have questions every now and then that you could use some help with?

With our Xero Software Bookkeeping Support packages, we are on hand to answer any queries you have. Contact us via email and we will respond to your query within 2 working days.

Please contact us if you would like to take advantage of this service or if you have any questions.

Monthly fee* £40 Payable monthly in advance by direct debit

6-month package £192 (Saving 20%). Payable in advance

*minimum 2 month period required

Please note: All prices are per person and are for advice and support only. If you require help carrying out your bookkeeping tasks this will incur an additional cost that will be discussed at the time. Prices are excluding VAT

Cancellations:

Monthly fee: Cancellations can be requested at any time. Cancellation requests must be received by us in writing no later than 14 days before the end of your current paid period.

6-month package: Cancellations may be requested for the end of the 6-month period. Requests must be received by us in writing no later than 14 days before the end of your current 6-month paid period.

Are you ready for Making Tax Digital for Income Tax Self Assessment?

Are you ready for Making Tax Digital for Income Tax Self Assessment?

From April 2026, self-employed individuals and landlords with an income of more than £50,000 will be required to keep digital records and provide quarterly updates on their income and expenditure to HMRC through MTD-compatible software. Those with an income of between £30,000 and £50,000 will need to do this from April 2027. Most customers will be able to join voluntarily beforehand allowing time to get used to the new style of reporting.

If this is something you would like to discuss then please get in touch so we can assist you in becoming compliant and help make the transition less stressful.

Are you ready for Making Tax Digital for Income Tax Self Assessment?

Are you ready for Making Tax Digital for Income Tax Self Assessment?

From April 2026, self-employed individuals and landlords with an income of more than £50,000 will be required to keep digital records and provide quarterly updates on their income and expenditure to HMRC through MTD-compatible software. Those with an income of between £30,000 and £50,000 will need to do this from April 2027. Most customers will be able to join voluntarily beforehand allowing time to get used to the new style of reporting.

If this is something you would like to discuss then please get in touch so we can assist you in becoming compliant and help make the transition less stressful.

Please feel free to contact us to discuss how we can help you.

We are based in Fleet, Hampshire and cover approximately a 5 mile radius in which are able to visit your premises. We also work remotely and help the majority of our clients via this method. Call us on 01252 594141 or use the contact form below.