Managing cash flow is essential for the health and sustainability of any small business.

One of the most effective ways to ensure a steady cash flow is by applying strong credit control practices.

At Perfect Balance, we believe that helping clients stay on top of their finances is crucial.

To assist small businesses in improving their credit control, here are our top tips for keeping cash flowing, reducing late payments and maintaining strong client relationships.

Set clear credit terms upfront

Having clear and transparent credit terms is one of the best ways to manage client expectations and avoid misunderstandings.

For example, set payment terms of 7, 14, or 30 days? Make sure clients know exactly when they need to pay.

Late payment fees: State your late payment policy upfront. The Late Payment of Commercial Debts (Interest) Act in the UK allows businesses to charge statutory interest on overdue invoices.

Discounts for early payments: This can incentivise clients to settle invoices promptly.

Including these details in contracts and on invoices is a straightforward way to make sure everyone is on the same page from the start.

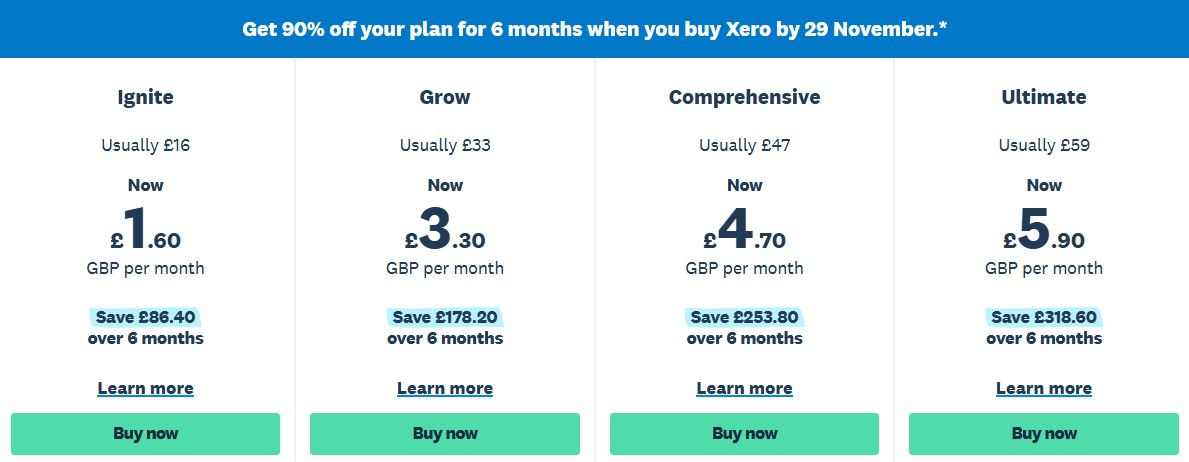

Use invoicing software

Invoicing software can streamline your entire billing process, reducing errors and automating reminders. By investing in software that tracks sent, pending, and overdue invoices, you can maintain a more organised and efficient credit control system. Our favourite tool is Xero, which offers an all-in-one solution that integrates smoothly with bookkeeping software, making it easy to track payments and stay on top of client accounts. Right now, Xero has an excellent offer: if you sign up before the 29th of November, you can get 90% off for six months, with prices starting as low as £1.60 per month! This is a fantastic opportunity to access professional invoicing and credit control tools at a fraction of the usual cost, helping you save on time and costs right from the start.

Have a consistent follow-up process

Once an invoice is overdue, it’s important to act quickly. Implement a follow-up process that includes:

Friendly reminders: Start with a polite email reminder as soon as the invoice is overdue.

Phone call: If the payment is still outstanding, follow up with a phone call. It’s harder to ignore a personal call than an email.

Formal letter: For seriously overdue accounts, send a formal letter outlining the consequences of continued non-payment.

Consistency is key. Don’t wait too long between reminders—keeping communication open shows you take credit control seriously.

Debt chasing: Sometimes it is necessary to instruct Debt Collectors to help recover and debts owed to you. We recommend taking a look at GetPaid who offer a seamless and inexpensive debt collecting service which links with your software. https://bizzctrl.com/

Offer multiple payment options

Offering various payment methods can make it easier for clients to pay promptly. Consider options like:

Bank transfer: The most common and direct payment method.

Direct Debit: Services like GoCardless allow you to set up automatic payments.

Credit/Debit Card Payments: Services like Stripe and PayPal can make it easier for clients to settle invoices on time.

The more convenient you make it; the faster clients are likely to pay.

Review your clients regularly

Keep an eye on your clients’ payment history. If you notice a client consistently pays late, consider adjusting their credit terms. This might mean shortening payment periods or requiring upfront payments. Additionally, regular reviews can help you spot red flags early, allowing you to take action before the problem escalates.

Consider credit insurance

If you deal with large invoices or have concerns about a client’s financial stability, credit insurance might be worth considering. It provides protection against the risk of non-payment, giving you peace of mind and helping to protect your cash flow.

In conclusion, credit control is crucial for maintaining a healthy cash flow in your business. By following these tips, you can significantly reduce late payments and enjoy a smoother, more predictable revenue stream. We understand that following these steps may take a bit of extra effort initially, but the payoff, in better cash flow and fewer financial headaches, makes it well worth it.

If you’re a small business owner looking for help with credit control or bookkeeping, get in touch with us! At Perfect Balance, we have a friendly, dedicated team ready to support you every step of the way. Whether you need assistance setting up invoicing software, managing your bookkeeping, or strengthening credit control processes, we’re here to help you achieve financial stability and success.